#14 DeFi Oracles are Broken

In this post, we will deep dive into OEV, and its implications on DeFi

DeFi Oracles are broken.

DeFi users lose millions of dollars because of Oracles.

Let's talk about OEV : The biggest problem in DeFi Oracles.

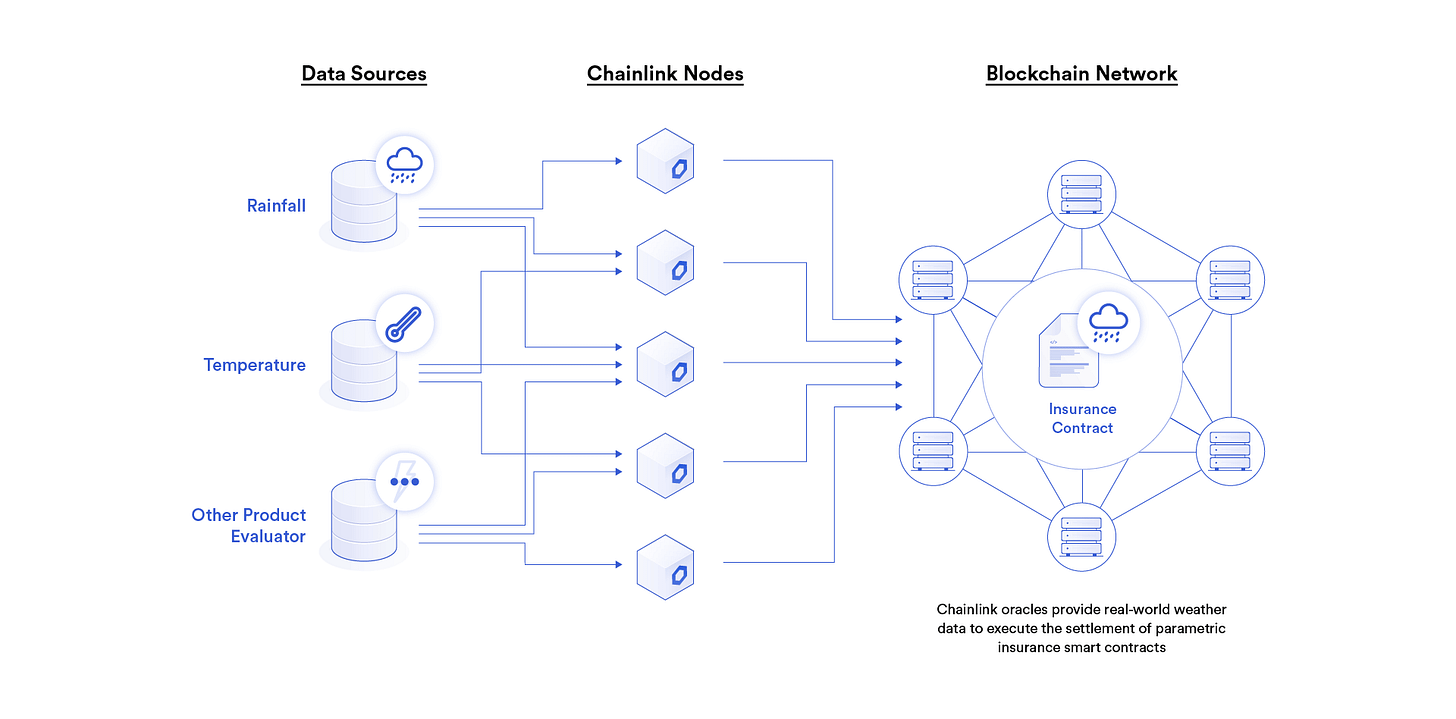

How DeFi Oracles Work

DeFi Oracles provide off-chain data, such as price feeds, to DApps whenever they need it. They don't update data in real-time; instead, they have some latency period.

In the case of Chainlink, it's 10-60 minutes for a few price feeds, and in the case of Pyth, they have some milliseconds of latency. The latency will always be present, and node operators have access to the price feed during the latency period.

Node operators could exploit these information to capitalize on it, similar to how miners and validators work with certain MEV Searchers to include their transactions with priority during arbitrage opportunities.

That comes to MEV

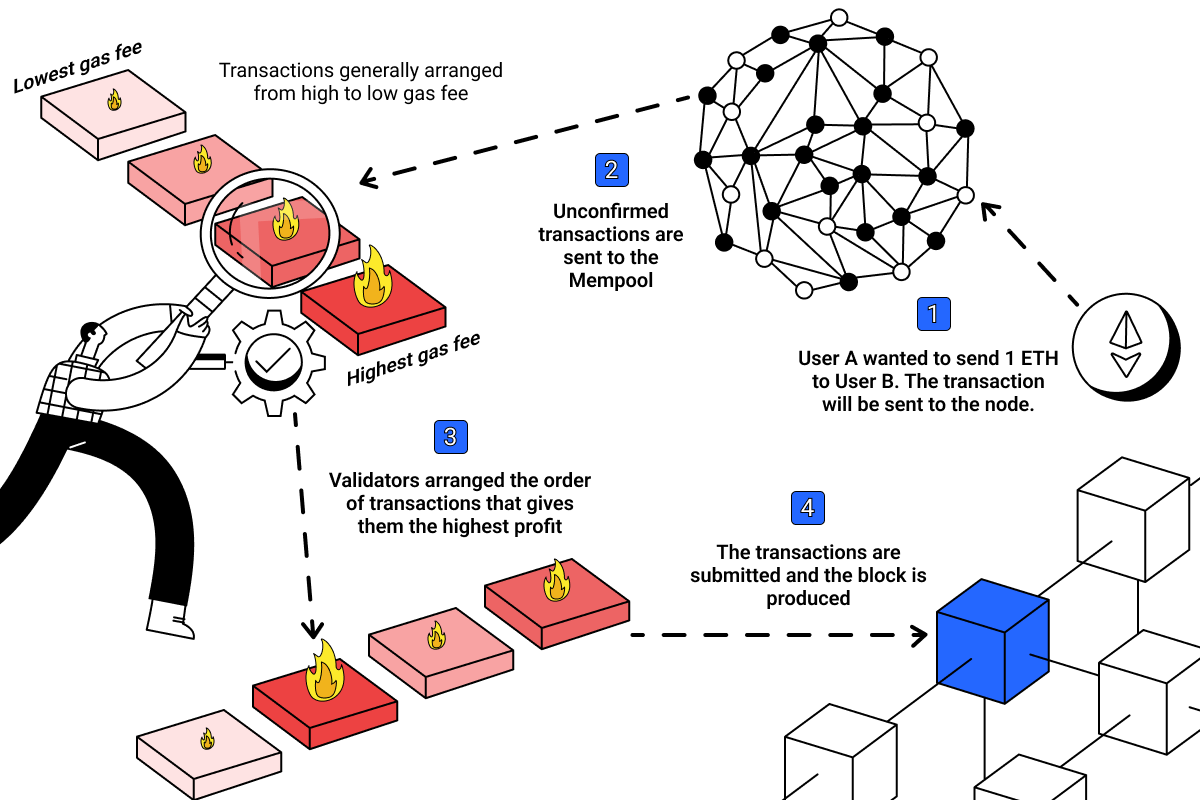

MEV - Miner Extractable Value.

Miners and validators have some sort of control in ordering transactions, so they take advantage of it whenever an MEV Searcher finds a profitable arbitrage or liquidation opportunity. They pay bribes to validators for prioritization.

OEV : Oracle Extractable Value

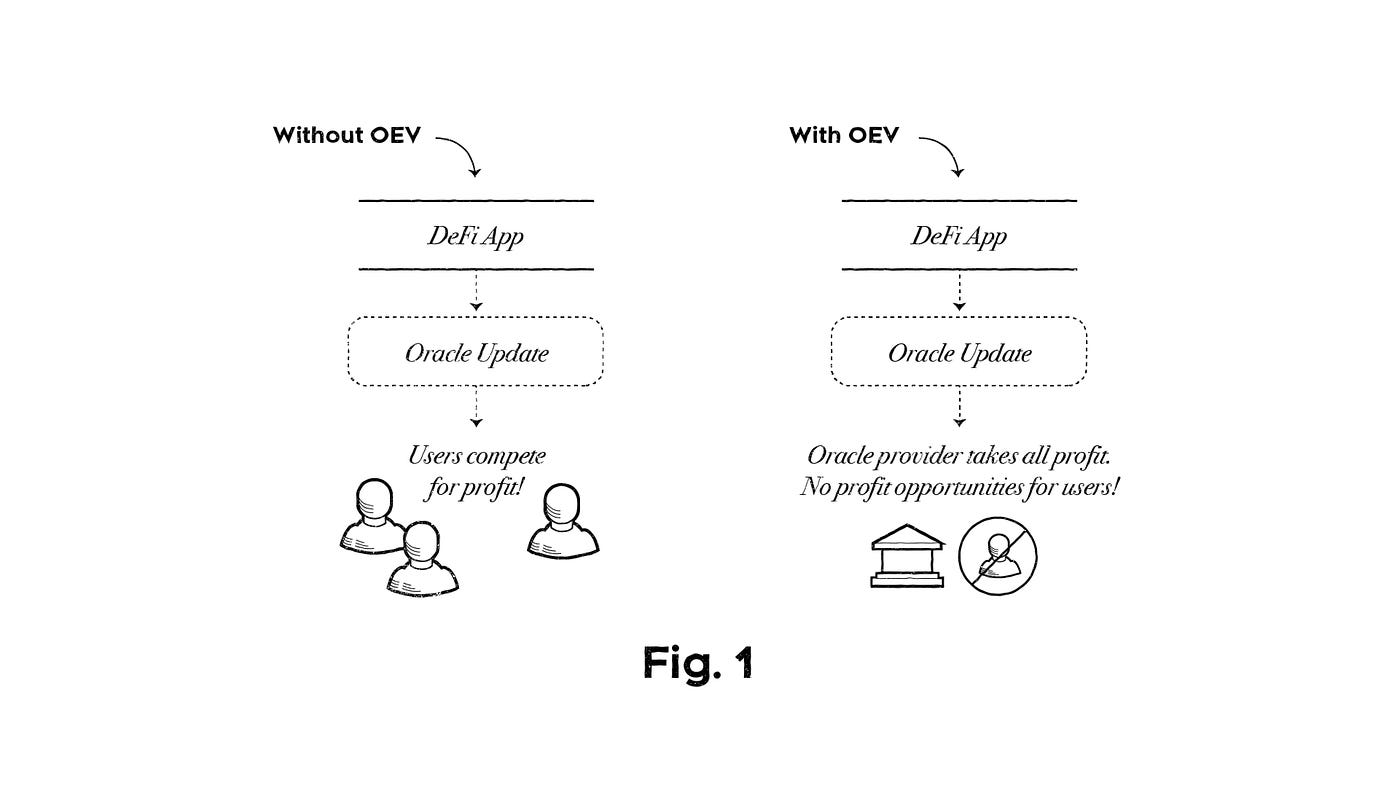

In a similar context to MEV, we have OEV (Oracle Extractable Value) because we have nodes that receive price feeds. Since they don't update them in real-time, there is a scope for passing these opportunities to searchers and extracting that value.

Who pays for all the value extractable by OEV Searchers?

It's the DApp where the OEV has been extracted. AAVE has been facing these attacks for a long time.

So what if an oracle designs a way where they could extract the OEV value themselves by running their own searcher bots and pass on that value to the DApp? It will eventually save millions for lending markets like Aave.

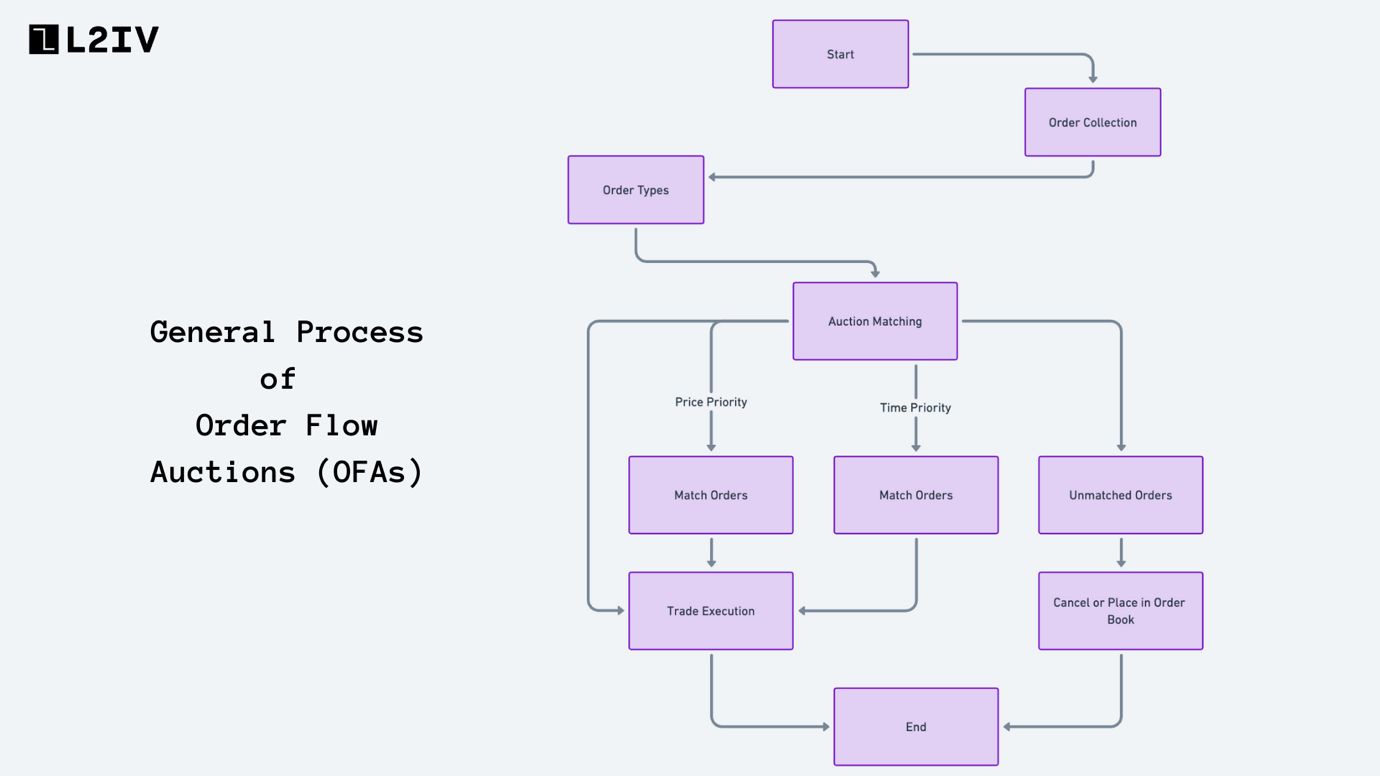

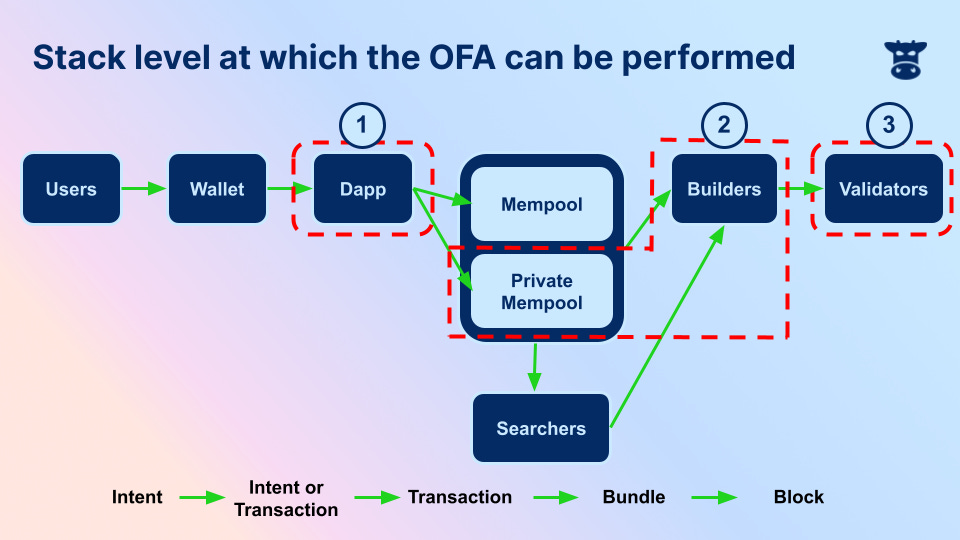

And the potential solution to achieve OEV extraction would be something similar to what Flashbots has implemented for MEV extractions. They created an open market for MEV, which uses OFA: Order Flow Auctions.

What is Order flow auction then?

Generally, MEV Searchers used to target single transactions, which used to have a bigger impact on a user in terms of value extraction. Order flow auctions aggregate multiple transactions, create batches of them, and put them up for auction.

MEV Searchers can bid on these auctions, and the highest bid will win the auction. The winner would be able to execute transactions with priority over others, and the bidding fees will go to the validators who will include that transaction in the block.

In the context of OEVs, we need a similar fair system where OEV value could be extracted by Oracle service providers, and they could pass that value to the DApp. API3 has pioneered OEV extraction through order flow auctions.

Read this article for more context on API3 Approach

https://medium.com/api3/oracle-extractable-value-oev-13c1b6d53c5b

Another decentralized oracle called UMA also teased a similar solution two days ago, which will be launching soon. Both UMA and API3 also experienced a significant increase in buying volume two days ago.

since I explained the whole context around OEV and the importance of having an OEV share in place, I think oracles like @UMAprotocol and @API3DAO are solving some serious problems, and they do have the potential to increase their market share in the oracle category.

Also, I am not offering any financial advice here. Use this thread as educational material that could help you get an overview of OEV.